Deal by deal investment

Hikari receives deals from various sources of which are only presented to our closed group of vetted investors. Being part of the Hikari Family enables direct access to high quality mortgage funds secured by real estate assets.

50+ Investors

$233M Deals

$23.6M Deals Funded

What We Offer

Real Estate Mortgage Funds

Real estate mortgage funds are basically that, mortgages held over real estate assets. These residential or commercial assets are put up as collateral on a first or second ranking mortgage. With each different mortgage ranking, a risk weighted rate of return is provided to the investors. The underlying asset is always the bricks and mortar that is placed as collateral security.

Private Equity Fund

Private Equity Fund is where alternative investments are placed. These investments take a sophisticated form in alternative types of investments (ie; wine barrels, whisky barrels, film financing, tech financing etc). Alternative Investment assets are not for the faint hearted and can be financially rewarding. Hikari takes the legwork out of sourcing and analysing the investment before presenting the Deal to our family.

Capital PE Fund

These are Deals that require an element of joint venture partnership with an equity/capital involvement, coupled with a pre-negotiated fixed return. It is one for those that are looking to be more actively involved in the operation and direction of the business, think Angel Investing with a return.

FAQS

What is Real Estate Mortgage Fund, and How Does It Work?

Real estate mortgage fund investment is a strategy where an investor invests funds into a contributory fund that lends the funds to a borrower who has put up an eligible property as collateral. Much like the banks. At Hikari Private, each fund is specific in nature and is allocated fully to a single deal.

What Are the Key Benefits of Working with Hikari Private?

Working with Hikari Private offers several key benefits. Firstly, we provide exclusive access to off-market mortgage fund deals. Being an unregistered managed investment scheme, deals are only presented to an exclusive tight-knit community of investors known to Hikari Private.

Do I Need a Lot of Money to Start investing in Real Estate Mortgage Funds?

Yes. As the average mortgage in Australia is $625,000. Minimum investment amounts range from $50,000, $100,000, and $250,000 for larger mortgage funds.

Get In Touch

Phone: 1800 342 988

Email: [email protected]

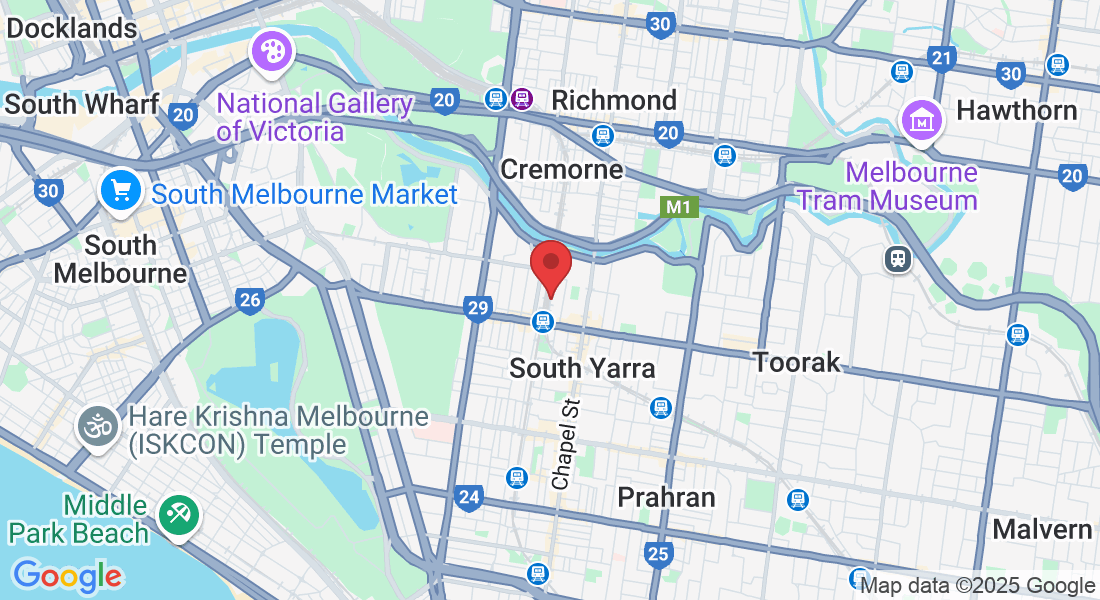

Address Office: Suite 1303, 9 Yarra St, South Yarra VIC 3141